FHA Loans Made Simple: Flexible Terms and Low Down Payments for Your New Home

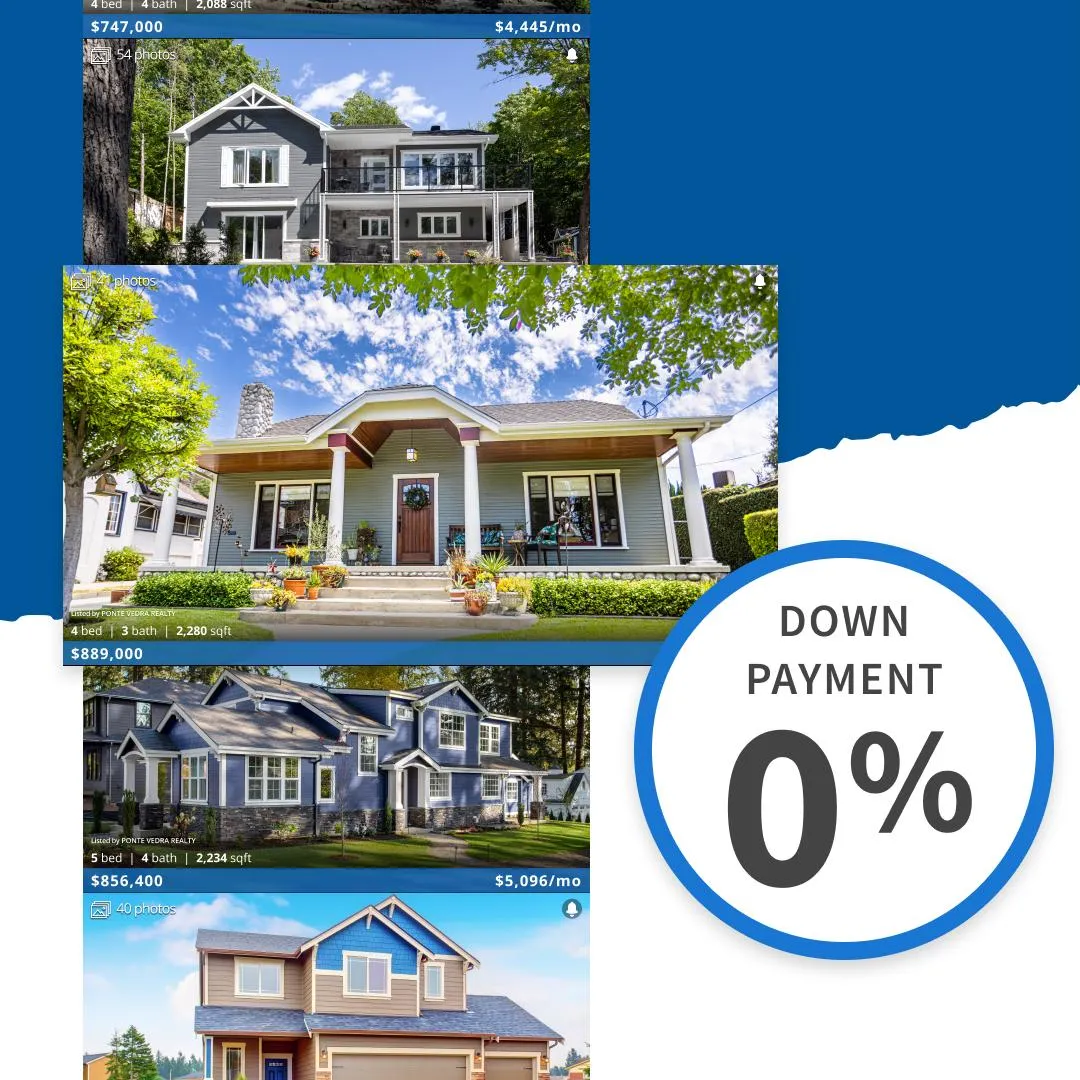

Low Down Payments

580 Minimum Score

Lower Interest Rates

Top FHA Lender for First Time Buyers

Mutual of Omaha Mortgage

Top Rated Mortgage Lender

FHA Purchase / FHA Streamline Options

Up To $10,500 Cash Back with MORE Rewards

We Offer 1% Down Payment Programs

Lightning Fast Digital Application

Pre-Approvals Without A Hard Credit Pull

Discover If You Qualify for FHA Financing

Instant Qualification Check

Find out in minutes if you meet the criteria for an FHA loan.

No obligation and no impact on your credit score.

Get personalized results tailored to your financial situation.

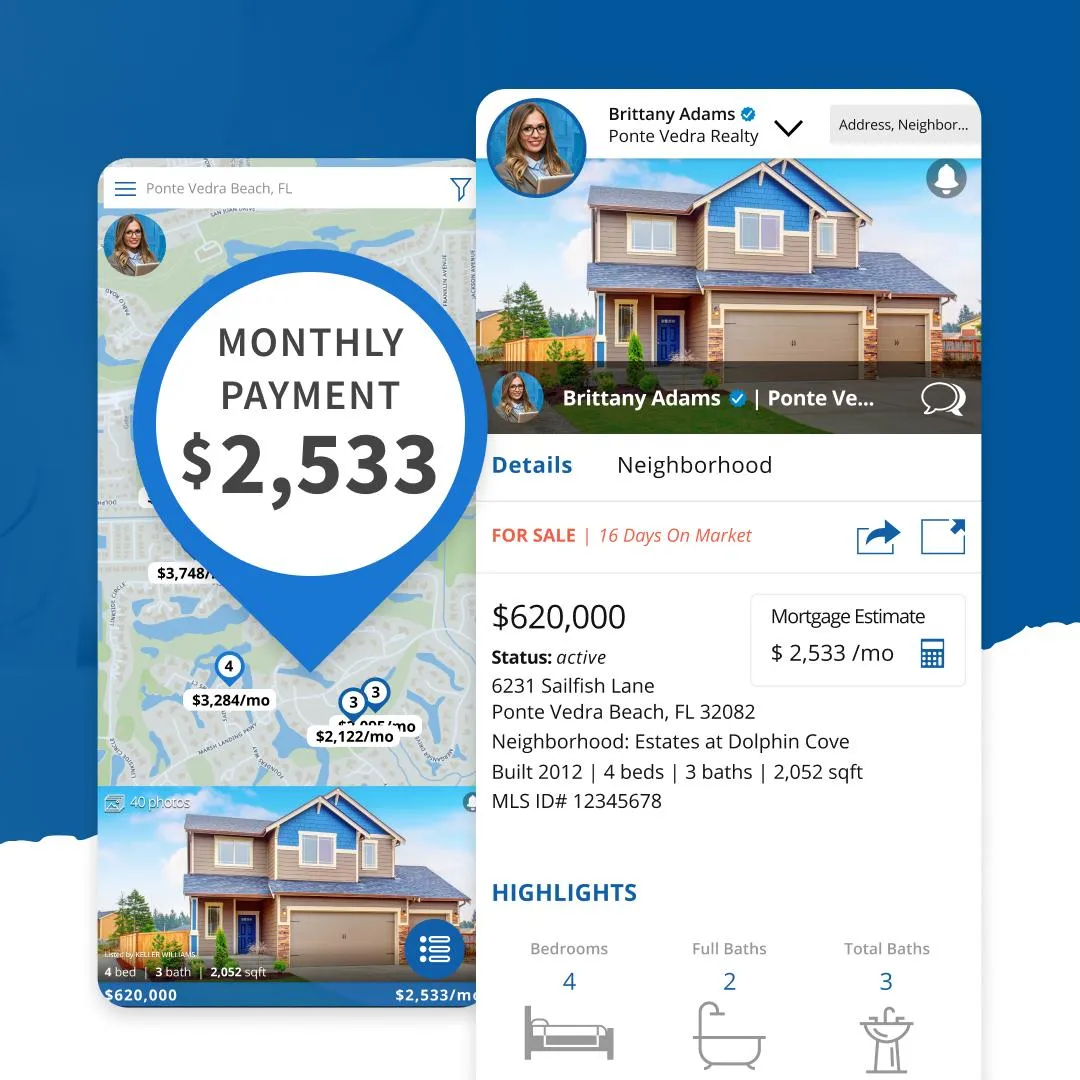

Find Homes That Fit Your Budget

Browse Homes in Your Price Range

See homes that match your housing payment range.

Access properties eligible for special financing programs.

Save time by viewing homes that fit your financial needs right away.

Enjoy Exclusive Property Insights

Special Finance Program Eligibility

Discover properties with unique financing options.

View homes that offer the best value for your budget.

Get detailed information on homes eligible for FHA, VA, Zero Down, First Time Homebuyer and other loan programs.

What is an FHA Loan?

An FHA loan is a mortgage that is insured by the Federal Housing Administration (FHA), a government agency that provides protection to lenders in case the borrower defaults. This insurance encourages lenders to offer loans to borrowers who may not qualify for conventional loans due to lower credit scores or smaller down payments

What are the Features of an FHA Loan?

Lower Credit Requirements: FHA loans are popular with first-time homebuyers and those with lower credit scores. A credit score of 580 or higher is typically required to qualify with a down payment of 3.5%, though some lenders may allow scores as low as 500 with a 10% down payment.

Low Down Payment: Borrowers can put down as little as 3.5% of the home's purchase price, making homeownership more accessible for those who may not have saved up a large down payment.

Mortgage Insurance Premiums (MIP): FHA loans require two types of mortgage insurance: an upfront mortgage insurance premium (UFMIP) that is typically 1.75% of the loan amount, and an annual mortgage insurance premium (MIP), which is paid monthly. This insurance protects the lender, not the borrower.

Flexible Debt-to-Income Ratios: FHA loans often allow borrowers with higher debt-to-income ratios to qualify compared to conventional loans, making it easier for those with other debts, such as student loans, to secure a mortgage.

Loan Limits: FHA loans have limits on how much you can borrow, which vary by location. In high-cost areas, these limits are higher to accommodate local housing prices.

Refinancing Options: FHA loans offer refinancing options, including streamline refinancing, which allows for a simplified process without requiring a full credit review, appraisal, or income verification in certain cases.

What are the Pro's and Con's of an FHA Loan?

Benefits of an FHA Loan:

Lower Credit Score Requirements: FHA loans are ideal for borrowers with lower credit scores. You can qualify with a score as low as 580 with a 3.5% down payment, and even with a score as low as 500 with a 10% down payment.

Smaller Down Payment: With an FHA loan, you can put down as little as 3.5% of the home’s purchase price, making it easier for buyers with limited savings to purchase a home.

Flexible Debt-to-Income Ratios: FHA loans often allow borrowers with higher debt-to-income (DTI) ratios to qualify, making it possible for those with existing debt (like student loans or car payments) to secure a mortgage.

Easier Refinancing: FHA loans offer streamlined refinancing options, which allow borrowers to refinance their loans with reduced paperwork and without a full credit review or appraisal.

Assumable Loans: FHA loans are assumable, meaning if you sell your home, the buyer can take over your mortgage, potentially benefiting from lower interest rates.

Drawbacks of an FHA Loan:

Mortgage Insurance Premiums (MIP): FHA loans require both an upfront mortgage insurance premium (UFMIP) and ongoing monthly mortgage insurance (MIP) payments. These insurance costs apply regardless of the size of your down payment and typically last for the life of the loan unless you refinance into a conventional mortgage.

Loan Limits: FHA loans have maximum loan limits that vary by location. In higher-cost areas, the limits are higher, but this can still restrict your ability to purchase more expensive properties.

Property Requirements: FHA loans have strict property standards to ensure the home meets safety and livability requirements. If a property needs significant repairs, it may not qualify for an FHA loan, or the repairs will need to be made before closing.

Mutual of Omaha Mortgage, Inc., NMLS ID 1025894. 3131 Camino Del Rio N 1100, San Diego, CA 92108. AL Consumer Credit License 22123; AK Broker/Lender License AK1025894. AZ Mortgage Banker License 0926603; AR Combination Mortgage Banker/Broker/Servicer License 109250; Licensed by the Department of Financial Protection & Innovation under the CA Residential Mortgage Lending Act, License 4131356; CO Mortgage Registration 1025894; CT Mortgage Lender License ML-1025894; DE Lender License 028515; DC Mortgage Dual Authority License MLB1025894; FL Mortgage Lender Servicer License MLD1827; GA Mortgage Lender License/Registration 46648; HI Mortgage Loan Originator Company License HI-1025894; ID Mortgage Broker/Lender License MBL-2081025894; IL Residential Mortgage Licensee MB.6761115; IN-DFI Mortgage Lending License 43321; IA Mortgage Banker License 2019-0119; KS Mortgage Company License MC.0025612; KY Mortgage Company License MC707287; LA Residential Mortgage Lending License 1025894; ME Supervised Lender License 1025894; MD Mortgage Lender License 21678; MA Mortgage Broker and Lender License MC1025894; MI 1st Mortgage Broker/Lender/Servicer Registrant FR0022702; MN Residential Mortgage Originator Exemption MN-OX-1025894; MS Mortgage Lender 1025894; MO Mortgage Company License 21-2472; MT Mortgage Broker and Lender License 1025894; NE Mortgage Banker License 1025894; NV Exempt Company Registration 4830. Licensed by the NH Banking Department, Mortgage Banker License 19926-MB; Licensed by the NJ Banking and Insurance Department. NJ Residential Mortgage Lender License 1025894; NM Mortgage Loan Company License 1025894; NC Mortgage Lender License L-186305; ND Money Broker License MB103387; OH Residential Mortgage Lending Act Certificate of Registration RM.804535.000; OK Mortgage Lender License ML012498; OR Mortgage Lending License ML- 5208; PA Mortgage Lender License 72932; RI Lender License 20163229LL. RI Loan Broker License 20163230LB; SC BFI Mortgage Lender/Servicer License MLS-1025894; SD Mortgage Lender License ML.05253; TN Mortgage License 190182; TX Mortgage Banker Registration 1025894; UT Mortgage Entity License 8928021; VT Lender License 6891; VA Mortgage Broker and Lender License, NMLS ID #1025894 (www.nmlsconsumeraccess.org); WA Consumer Loan Company License CL-1025894; WV Mortgage Lender License ML-1025894; WI Mortgage Banker License 1025894BA; WY Mortgage Lender/Broker License 3488. Toll Free #: (877) 978-1922. Subject to Credit Approval. For licensing information, go to: www.nmlsconsumeraccess.org

© Mutual of Omaha Mortgage. All Rights Reserved.